What is "full insurance coverage" vehicle insurance? The concept of "full protection" automobile insurance policy where you have total protection for your vehicle or vehicle would be wonderful. cars. However what does "complete insurance coverage" imply for auto insurance policy? Also, why can this term be misguiding when picking the ideal coverage for your lorry? To begin, there's no basic meaning of "complete insurance coverage" for vehicle insurance policy.

Based on your situation, your variation of complete insurance coverage insurance coverage may differ from a person else's. What coverages make up an auto insurance coverage policy?

The coverages and also limitations of coverage vary by state. Common Car Insurance Insurance Coverages Some automobile insurance coverage protections are required by your state.

It includes protection for bodily injury and home damage. These insurance coverages help offer defense if you're at fault in a crash as well as trigger injury or damage to an additional person or their property. Uninsured/Underinsured Motorist Coverage Uninsured motorist insurance coverage helps shield you if you're entailed in a crash with someone who does not have obligation insurance.

These insurance coverages might aid cover your injuries or building damage. These coverage requirements and also alternatives can differ extensively by state. We can assist you determine what is needed by your state. You might likewise find info on our state info pages. Medical Coverages Medical settlements or accident defense coverage are the most typical medical coverages.

The states establish which coverages are provided and have different policies about that and also what is covered. There are various other insurance coverages that are not called for by your state but can supply you with added security.

All About Does Car Insurance Cover Repairs? - Shift

You can utilize crash whether you're at mistake or not. It covers your lorry in the occasion of a theft or criminal damage.

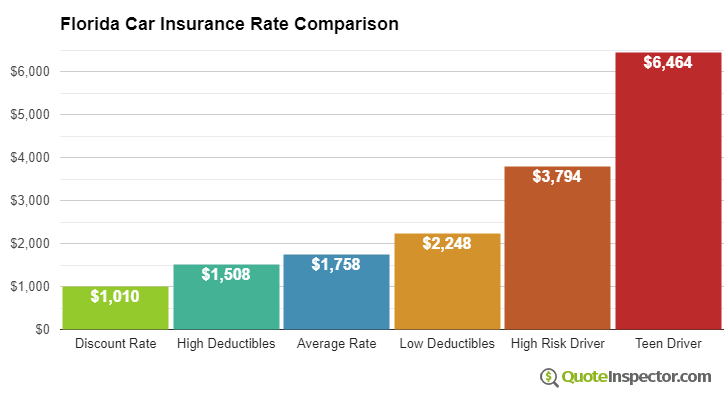

Your costs is affected by the types of insurance coverages, limits, and deductibles you choose. If you determine to lug greater restrictions than required by the state, the expense of your policy will most likely be even more than a person with the minimum restrictions of protection.

The above is meant as basic information and as general policy descriptions to help you comprehend the different sorts of protections - vehicle insurance. These descriptions do not refer to any type of certain contract of insurance policy and they do not modify any kind of definitions, exclusions or any kind of various other arrangement specifically stated in any contracts of insurance.

affordable credit score automobile auto insurance

affordable credit score automobile auto insurance

"Full coverage" is a common term used in vehicle insurance. Policies and also insurance coverage provided by insurance companies will certainly differ by state.

What Is Complete Insurance Coverage Insurance? Full insurance coverage frequently is a mix of insurance coverages that are called for by your state or demands.

Liability covers your responsibility to the various other chauffeur or to their passengers for injury and home damages. It's needed in virtually every https://average-cost-car-insurance-in-us-2022.fra1.digitaloceanspaces.com/index.html state. Accident coverage puts on harm that occurs to your cars and truck while it's being driven. Comprehensive coverage spends for things that take place to your vehicle beyond a crash.

3 Simple Techniques For 7 Types Of Car Insurance And What They Cover

Some states additionally need insurance coverage for uninsured or underinsured motorists. Some call for medical payments insurance coverage.

car cheaper car credit cheap car

car cheaper car credit cheap car

Clinical Repayments as well as Personal Injury Protection Medical repayments as well as personal injury protection are supplied at the degree established by state legislation. It may also cover shed wages and also other expenditures that stem from injuries endured from the mishap.

Their insurance policy, if any, might not be adequate to pay for medical costs. Check with your state to see what it requires.

You'll select your insurance coverage restrictions, as well as the quantity you must pay as an insurance deductible. These amounts will certainly impact your costs. Your loan provider might require this coverage if you bought your vehicle with a car loan. It's usually a choice or else. Comprehensive Insurance coverage Comprehensive insurance coverage spends for damages to your cars and truck that wasn't brought on by an accident.

Detailed insurance aids spend for damages to your auto that is outside of your control. Other Optional Insurance coverage You might think that towing and also auto services are included with complete protection - vehicle. That's not always the instance. Review your alternatives with your agent so you aren't captured by shock. You could be able to include a few choices to your policy at very little expense.

You should request it if you're obtaining a loan for a big section of your vehicle's worth - vehicle insurance. You'll have to pay for that "gap" out of pocket unless you have this coverage if you owe a lot more on your car loan than your cars and truck deserves, as well as you have a crash or your vehicle is taken.

Things about Full Coverage Car Insurance - Safeauto

This coverage typically does not come immediately with a complete coverage plan. Do I Need Complete Protection? Some insurance coverages are called for by legislation or by lending institutions. liability.

Yet bear in mind that you'll pay for that protection through high premiums. You may elect to choose less insurance coverage or greater deductibles if you have lots of cash conserved so you can soak up a lot of the expense of a crash. Clinical expenditures from an accident can be far extra pricey than getting a brand-new auto.

When it comes to automobile insurance policy, the old-time question is, How much vehicle insurance coverage do I need? You require coverage that in fact covers you, the kind that safeguards you from budget-busting auto wreckages - auto.

You're either covered or you're not. Among the large factors it's difficult to get the appropriate insurance coverage is because, let's encounter it, vehicle insurance coverage is confusing. That's why we're mosting likely to reveal you precisely what you need. For starters, a lot of motorists should contend the very least three sorts of auto insurance coverage: responsibility, extensive as well as crash - auto.

affordable auto insurance vehicle insurance car insure

affordable auto insurance vehicle insurance car insure

Why You Required Car Insurance coverage Driving about without cars and truck insurance policy is not only dumb with a funding D, it's additionally prohibited. One in eight Americans drives without some kind of car insurance policy in area. cheapest car.1 Do not do this. There are severe effects if you're caught on the road without auto insurance coverage.

We suggest having at the very least $500,000 well worth of total coverage that consists of both kinds of responsibility coverageproperty damages liability as well as physical injury liability. This way, if a mishap's your mistake, you're covered for costs associated to repairing the other motorist's car (residential property damage) and also any type of costs connected to their shed incomes or medical costs (physical injury) (prices).

Cost Of Cars Reddit. "Net Income Of $2. You Might Have A ... - The Facts

Below's what we state: If you can not change your automobile with cash, you should get accident. The only time you could not need collision is if your cars and truck is paid off as well as, once more, you might change it from your cost savings.

Currently, there are 22 states where you're either needed by law to have PIP or have the alternative to buy it as an add-on insurance coverage.5 If you reside in a state that requires you to carry PIP, you should make the most of the protection if you ever need it (business insurance).

Also though they would certainly be reducing you a rather large check, it still wouldn't be enough to pay off your financing. That's since new cars lose more than 20% in value in the first year.7 Yikes! Void insurance policy loads this "gap" by covering the remainder of what you still owe on your loan.

If you think you'll need this back-up plan in location, it's not a bad idea to add this to your policy. insurance. Pay-Per-Mile Insurance coverage If your vehicle has a tendency to being in the garage accumulating dust, you might be interested in pay-per-mile protection. With this protection, a general practitioner gadget is installed in your car so you're billed per mile, as opposed to a yearly price quote.

Glass Coverage If you live beside a golf links, you might have found on your own wishing you had glass insurance coverage to pay for the cost of fixing or replacing the home windows on your cars and truck - cars. Some insurance provider use glass protection without any insurance deductible, yet the price of the included coverage may outweigh the benefits, particularly with some policies just covering the windshield.

That makes far more feeling! Whatever you wind up doing, there are whole lots of means to save money on vehicle insurance coverage. As well as if you have actually become aware of something called a "going away insurance deductible," no, it's not a magic trick. Your repayments definitely will not disappear right into thin air. Some insurer use vanishing deductibles at an additional expense for drivers with a lengthy history of risk-free driving.

3 Simple Techniques For Should You Waive Rental-car Insurance For Your Road Trip?

If your deductible is $500 as well as you've been accident-free for five years, your deductible would certainly go to $0. But the deductible re-emerges in complete the 2nd you enter into an accident. Ta-da! Factoring in the additional price of the coverage, you're typically far better off conserving that cash to put towards your debt snowball or reserve.

If you stay out of problem awhile, your costs will ultimately come back down to earth. Another point that could trigger your costs to go up is if you're regularly submitting claims. So if you have $250 worth of job many thanks to a fender bender, you could not intend to file that case.

Your objective is to locate your auto insurance policy pleasant area. The best method to do this is by working with an independent insurance policy agent that is component of our Supported Neighborhood Suppliers (ELP) program.

You must hang on to full-coverage car insurance coverage up until your annual costs meets or exceeds the approximated payout if your auto requires to be repaired or changed. If your automobile is 5 or 6 years of ages, the payout for substitute possibly isn't worth what you pay in costs. This short article will cover: When should I drop full-coverage automobile insurance policy? As a whole, you ought to get rid of full-coverage auto insurance from your car if it isn't worth much or if it's old.